Service Based Business Society Blog

ENTREPRENEUR ARTICLES AND RESOURCES

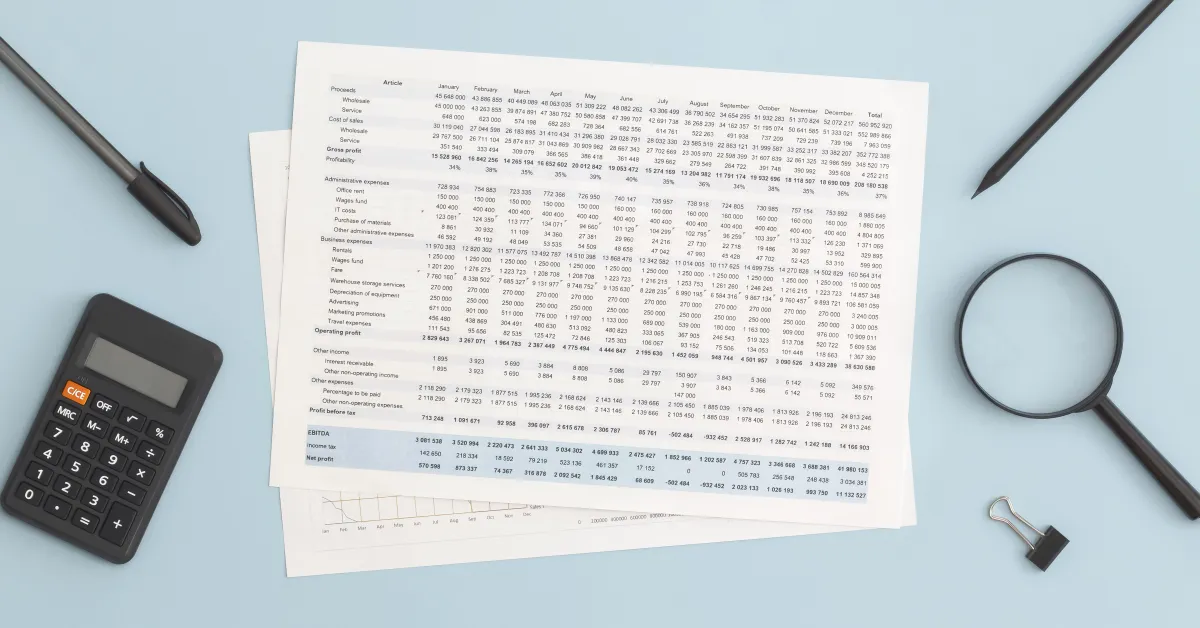

How to Read and Understand an Income Statement

How to Read and Understand an Income Statement

An income statement is a crucial financial report that shows a company's revenues, expenses, and profits over a specific period. For business owners and investors alike, understanding how to read and interpret this document is essential for making informed decisions. This financial statement provides a snapshot of a company's financial performance, revealing whether it's making money or losing it. In this guide, we'll walk you through the ins and outs of income statements, offering practical tips to help you decode these important financial documents. Whether you're a small business owner or an aspiring investor, mastering the art of reading income statements will give you valuable insights into a company's financial health and future prospects.

The Anatomy of an Income Statement

An income statement is like a report card for a company's financial performance. It shows how much money a business made and spent over a specific period. Let's break it down into simple parts:

Key Components

Revenue: This is all the money a company earns from selling its products or services. It's like the allowance you get for doing chores.

Expenses: These are the costs a company pays to run its business. Think of it as spending your allowance on toys or snacks.

Profit: This is what's left after subtracting expenses from revenue. It's like the money you save from your allowance.

Single-Step vs. Multi-Step Statements

There are two main types of income statements:

Single-step: This is the simpler version. It lists all revenues together and all expenses together, then shows the profit or loss.

Multi-step: This type gives more details. It breaks down revenues and expenses into different categories, like operating and non-operating.

Hidden Gems

Some parts of an income statement are easy to miss but super important:

Gross profit: This shows how much money is left after paying for the products sold.

Operating income: This tells you how much the company made from its main business activities.

Interest expenses: This is the cost of borrowing money.

Decoding Revenue Sources

Companies can make money in different ways:

Sales revenue: Money from selling products or services.

Service revenue: Income from providing services.

Interest revenue: Money earned from investments or loans.

Rental revenue: Income from renting out property or equipment.

Understanding these different types of revenue helps you see how a company makes its money. For example, a toy store might make most of its money from sales revenue, while a bank earns a lot from interest revenue.

By learning to read an income statement, you can understand how well a company is doing and where its money comes from. It's like peeking into a business's piggy bank!

Beyond the Numbers: Contextual Analysis

When reading an income statement, it's crucial to look beyond the raw numbers. Understanding the industry context can provide valuable insights into a company's financial health and performance.

Industry-Specific Characteristics

Different industries have unique characteristics that shape their income statements. For example:

Retail: These businesses often have high cost of goods sold and lower profit margins. Their income statements might show large revenue figures but smaller profits due to inventory costs.

Technology: Tech companies may have high research and development expenses. Their income statements might show significant spending in this area, which is essential for future growth.

Airlines: This industry typically has high operating costs, including fuel and maintenance. Their income statements often reflect thin profit margins due to these expenses.

Pharmaceuticals: These companies usually have substantial research and development costs. Their income statements might show years of losses before a successful drug launch leads to profits.

Contextual Analysis in Action

Let's imagine two companies with similar revenue figures:

Company A (Retail): $1 billion in sales, $100 million in profit

Company B (Software): $1 billion in sales, $400 million in profit

At first glance, Company B seems more successful. However, when we consider industry context:

Retail typically has lower profit margins due to inventory costs and overhead.

Software companies often have higher margins because their product is digital and easily scalable.

This context helps us understand that Company A might be performing well for its industry, while Company B is operating within expected norms for software.

Why Context Matters

Understanding industry context allows you to:

Make fair comparisons between companies

Identify potential red flags or standout performers

Assess a company's efficiency within its sector

By looking beyond the numbers and considering industry-specific factors, you can gain a deeper understanding of a company's financial story. This contextual analysis is key to making informed decisions, whether you're an investor, analyst, or business owner.

Remember, an income statement is just one piece of the puzzle. Combine it with industry knowledge, and you'll have a much clearer picture of a company's financial health and prospects.

Common Pitfalls in Income Statement Interpretation

When it comes to reading an income statement, even seasoned professionals can make mistakes. Let's explore some common pitfalls and how to avoid them.

Overlooking the Big Picture

One of the biggest mistakes people make is focusing too much on a single number. For example, you might see a company's revenue skyrocket and think, "Wow, they're doing great!" But hold on a second! What if their expenses grew even faster? That's why it's crucial to look at the whole statement.

Imagine you're running a lemonade stand. You sold $100 worth of lemonade (yay!), but spent $120 on lemons and sugar (oops!). Even though your sales were high, you actually lost money. This is why we need to consider both income and expenses.

Ignoring Non-Cash Items

Another tricky area is non-cash items. These are things that affect the income statement but don't involve actual money changing hands. For example, depreciation is a cost that spreads the price of a big purchase over time.

Let's say your lemonade stand bought a fancy juicer for $1000. Instead of showing it as one big expense, you might spread it out over five years. Each year, you'd show a $200 depreciation cost on your income statement. This helps match the cost with the benefit you get from using the juicer over time.

Red Flags and Warning Signs

Now, let's talk about some warning signs that might pop up on an income statement.

Unexplained Changes in Profit Margins

If a company's profit margin suddenly changes without a good reason, it's time to dig deeper. For instance, if the cost of goods sold stays the same but the gross profit drops, something fishy might be going on.

Remember Enron? This energy company looked super successful on paper, but it was hiding massive debts and inflating profits. Their income statements showed incredible growth year after year, which should have raised eyebrows. When the truth came out, the company collapsed, shocking the business world.

Inconsistent Revenue Recognition

Another red flag is when a company's revenue seems out of sync with its business model. For example, if a subscription-based service suddenly reports a huge spike in one-time sales, it might be trying to make its numbers look better than they really are.

By keeping an eye out for these pitfalls and red flags, you'll be better equipped to understand what an income statement is really telling you about a company's financial health.

Comparative Analysis: Benchmarking Performance

When it comes to understanding how well your business is doing, comparing income statements is like having a superpower. It's not just about looking at one piece of paper and calling it a day. No way! We need to put on our detective hats and do some serious sleuthing.

Why Comparing Income Statements Matters

Imagine you're running a lemonade stand. You want to know if you're making more money this summer than last summer, right? That's exactly why we compare income statements across different time periods. It helps us see if our business is growing or if we need to make some changes.

But wait, there's more! We also want to know how we're doing compared to other lemonade stands in the neighborhood. That's where comparing with competitors comes in handy. It's like a friendly competition to see who's selling the most lemonade!

How to Compare Income Statements Like a Pro

Line Up Your Statements: First, grab your income statements from different time periods or from your competitors. Put them side by side like you're lining up for a race.

Look at the Big Numbers: Start with the total revenue. Is it going up or down? This tells you if you're selling more or less lemonade over time.

Check Out the Costs: Now, look at your expenses. Are you spending more on lemons and sugar? This helps you understand if your costs are under control.

Calculate Percentages: Don't just look at the numbers, turn them into percentages. If your lemonade sales went up by 10% but your costs went up by 20%, that's important to know!

Spot the Trends: Look for patterns. Are your sales always better in July? Do you spend more on ice in August? Understanding these trends can help you plan better.

Compare with Competitors: If you have info on other lemonade stands, see how your numbers stack up. Maybe they're selling more lemonade, but you're making more profit per cup!

Ask Why: For any big differences you see, ask yourself why. Did you raise your prices? Did a new lemonade stand open nearby? Understanding the reasons behind the numbers is super important.

By following these steps, you'll become a pro at comparing income statements. It's like having X-ray vision for your business! Remember, the goal is to use this information to make your lemonade stand (or any business) even better. So put on those detective glasses and start comparing!

Advanced Techniques for Income Statement Analysis

When you're ready to dive deeper into understanding a company's financial health, it's time to explore some advanced techniques for analyzing income statements. Let's look at two powerful methods that can give you a clearer picture of how a business is performing.

Ratio Analysis: Crunching the Numbers

Ratio analysis is like using a magnifying glass on the income statement. It helps you spot important relationships between different numbers. Here are a few key ratios to consider:

Gross Profit Margin: This shows how much money is left after paying for the costs of goods sold. A higher margin usually means the company is doing well.

Operating Profit Margin: This tells you how much profit a company makes from its core business operations.

Net Profit Margin: This is the percentage of revenue that turns into profit after all expenses are paid.

By comparing these ratios over time or with other companies in the same industry, you can get a better sense of how well a business is managing its money.

Trend Analysis: Spotting Patterns

Trend analysis is like being a detective, looking for clues about a company's financial story over time. Here's how it works:

Gather income statements from several years.

Look at how key items like revenue, expenses, and profit change from year to year.

Ask yourself: Are sales growing steadily? Are expenses increasing faster than revenue?

This method can help you predict future performance and spot potential problems before they become big issues.

Leveraging Technology for Easier Analysis

Gone are the days of crunching numbers with just a calculator and pencil. Now, there are cool tools that make analyzing income statements much easier:

Spreadsheet Software: Programs like Excel or Google Sheets can help you organize data and create charts to visualize trends.

Financial Analysis Apps: These can automatically calculate ratios and create reports, saving you tons of time.

Data Visualization Tools: Turn boring numbers into exciting charts and graphs that tell a clear story about a company's performance.

With these advanced techniques and modern tools, you'll be able to unlock deeper insights from income statements and make smarter financial decisions. Remember, practice makes perfect, so don't be afraid to dive in and start analyzing!

The Role of Income Statements in Decision-Making

Income statements are like report cards for businesses. They show how much money a company made and spent over a certain time. Different people use these statements to make important choices. Let's explore how!

How Stakeholders Use Income Statements

Investors love income statements. They look at the profit to see if a company is doing well. For example, if a company's profit goes up every year, investors might decide to buy more of its stock.

Managers use income statements to make big decisions. Imagine a toy company sees that its expenses for making toys are too high. The manager might decide to find cheaper ways to make toys or raise prices to cover the costs.

Banks also look at income statements when a business asks for a loan. If the statement shows the company is making good money, the bank might say yes to the loan.

Real-Life Example: Apple's Big Decision

In 2016, Apple looked at its income statement and saw that iPhone sales were slowing down. This led to a big decision. They started focusing more on services like Apple Music and the App Store. This smart move helped Apple keep making money even when fewer people were buying new phones.

Connecting Income Statements with Other Financial Reports

Income statements don't work alone. They team up with other reports like balance sheets and cash flow statements. Together, these reports give a full picture of a company's health.

Think of it like a doctor checking your heart, lungs, and blood pressure to see how healthy you are. In the same way, looking at all these reports together helps business people make better choices.

For instance, a company might show good profits on its income statement. But if the cash flow statement shows it's having trouble collecting money from customers, that's a red flag. This complete view helps avoid making decisions based on just one part of the financial story.

By understanding how to read income statements and use them with other financial reports, anyone can make smarter choices about business and money. It's like having a superpower in the world of finance!

From Analysis to Action: Applying Income Statement Insights

Once you understand how to read an income statement, it's time to put that knowledge to work. Let's explore how you can use income statement analysis to boost your business performance and learn from successful companies.

Practical Tips for Driving Business Improvements

Track your profit margins: Keep a close eye on your gross profit margin and operating profit margin. If these numbers are shrinking, it's time to look for ways to cut costs or increase prices.

Analyze expense trends: Look at how your expenses change over time. Are certain costs growing faster than your revenue? This might be a red flag that needs attention.

Compare with industry benchmarks: See how your numbers stack up against similar companies. This can help you spot areas where you're falling behind or excelling.

Use ratios for deeper insights: Calculate ratios like the profit margin or operating expense ratio to get a clearer picture of your financial health.

Real-World Success Stories

Starbucks' Cost-Cutting Strategy: In 2008, Starbucks noticed their expenses were growing faster than revenue. By analyzing their income statement, they identified areas to cut costs, like closing underperforming stores and reducing supply chain expenses. This helped them save $580 million in just one year!

Amazon's Long-Term Vision: Amazon's income statements often showed losses in its early years. But by focusing on revenue growth and market share rather than short-term profits, they built a business that now dominates e-commerce.

Apple's Product Mix Optimization: By closely monitoring the profit margins of different product lines on their income statement, Apple has been able to focus on high-margin items like the iPhone and services, boosting overall profitability.

Remember, your income statement is more than just numbers on a page. It's a powerful tool that can guide your business decisions and strategy. By regularly analyzing your income statement and acting on those insights, you can drive real improvements in your business performance. Don't be afraid to dig into the details – that's where the most valuable insights often hide!

Driving Financial Success: Your Next Steps

As we've journeyed through the world of income statements, it's clear that mastering this financial tool is crucial for business growth. Whether you're steering a trucking company or managing a small enterprise, understanding your income statement empowers informed decision-making. But why stop here? At Path 2 Profit Bookkeeping, we're passionate about turning financial insights into actionable strategies. Ready to take your financial understanding to the next level? Let's chat about how we can help you navigate your business's financial landscape. Book a free consultation call today, and let's pave your path to profit together!

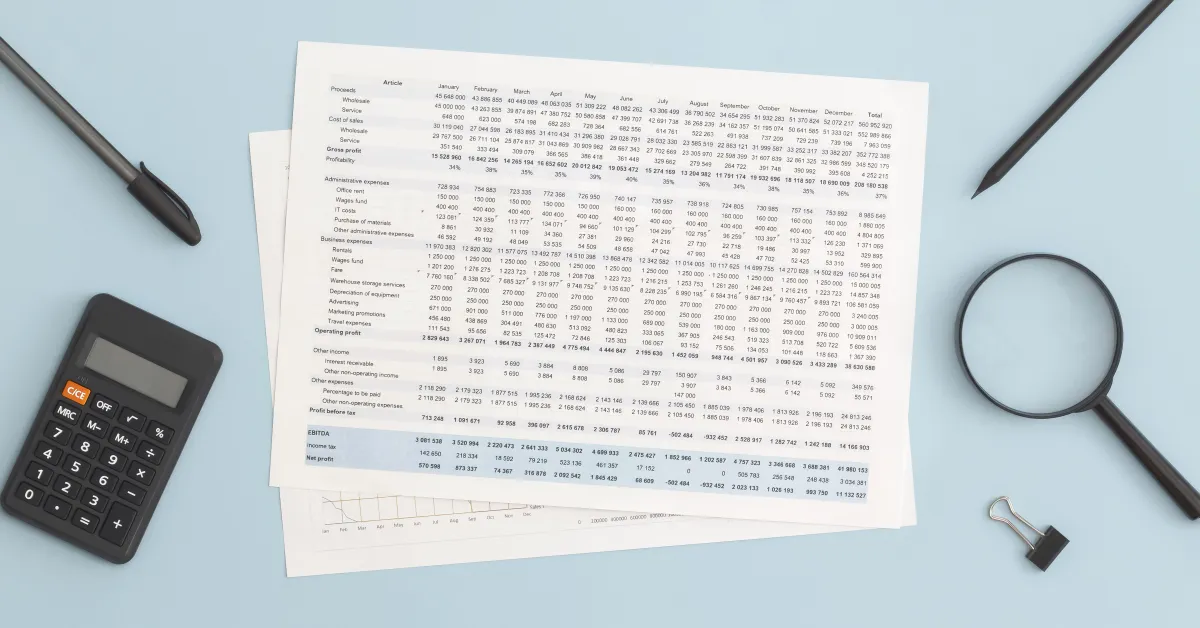

How to Read and Understand an Income Statement

How to Read and Understand an Income Statement

An income statement is a crucial financial report that shows a company's revenues, expenses, and profits over a specific period. For business owners and investors alike, understanding how to read and interpret this document is essential for making informed decisions. This financial statement provides a snapshot of a company's financial performance, revealing whether it's making money or losing it. In this guide, we'll walk you through the ins and outs of income statements, offering practical tips to help you decode these important financial documents. Whether you're a small business owner or an aspiring investor, mastering the art of reading income statements will give you valuable insights into a company's financial health and future prospects.

The Anatomy of an Income Statement

An income statement is like a report card for a company's financial performance. It shows how much money a business made and spent over a specific period. Let's break it down into simple parts:

Key Components

Revenue: This is all the money a company earns from selling its products or services. It's like the allowance you get for doing chores.

Expenses: These are the costs a company pays to run its business. Think of it as spending your allowance on toys or snacks.

Profit: This is what's left after subtracting expenses from revenue. It's like the money you save from your allowance.

Single-Step vs. Multi-Step Statements

There are two main types of income statements:

Single-step: This is the simpler version. It lists all revenues together and all expenses together, then shows the profit or loss.

Multi-step: This type gives more details. It breaks down revenues and expenses into different categories, like operating and non-operating.

Hidden Gems

Some parts of an income statement are easy to miss but super important:

Gross profit: This shows how much money is left after paying for the products sold.

Operating income: This tells you how much the company made from its main business activities.

Interest expenses: This is the cost of borrowing money.

Decoding Revenue Sources

Companies can make money in different ways:

Sales revenue: Money from selling products or services.

Service revenue: Income from providing services.

Interest revenue: Money earned from investments or loans.

Rental revenue: Income from renting out property or equipment.

Understanding these different types of revenue helps you see how a company makes its money. For example, a toy store might make most of its money from sales revenue, while a bank earns a lot from interest revenue.

By learning to read an income statement, you can understand how well a company is doing and where its money comes from. It's like peeking into a business's piggy bank!

Beyond the Numbers: Contextual Analysis

When reading an income statement, it's crucial to look beyond the raw numbers. Understanding the industry context can provide valuable insights into a company's financial health and performance.

Industry-Specific Characteristics

Different industries have unique characteristics that shape their income statements. For example:

Retail: These businesses often have high cost of goods sold and lower profit margins. Their income statements might show large revenue figures but smaller profits due to inventory costs.

Technology: Tech companies may have high research and development expenses. Their income statements might show significant spending in this area, which is essential for future growth.

Airlines: This industry typically has high operating costs, including fuel and maintenance. Their income statements often reflect thin profit margins due to these expenses.

Pharmaceuticals: These companies usually have substantial research and development costs. Their income statements might show years of losses before a successful drug launch leads to profits.

Contextual Analysis in Action

Let's imagine two companies with similar revenue figures:

Company A (Retail): $1 billion in sales, $100 million in profit

Company B (Software): $1 billion in sales, $400 million in profit

At first glance, Company B seems more successful. However, when we consider industry context:

Retail typically has lower profit margins due to inventory costs and overhead.

Software companies often have higher margins because their product is digital and easily scalable.

This context helps us understand that Company A might be performing well for its industry, while Company B is operating within expected norms for software.

Why Context Matters

Understanding industry context allows you to:

Make fair comparisons between companies

Identify potential red flags or standout performers

Assess a company's efficiency within its sector

By looking beyond the numbers and considering industry-specific factors, you can gain a deeper understanding of a company's financial story. This contextual analysis is key to making informed decisions, whether you're an investor, analyst, or business owner.

Remember, an income statement is just one piece of the puzzle. Combine it with industry knowledge, and you'll have a much clearer picture of a company's financial health and prospects.

Common Pitfalls in Income Statement Interpretation

When it comes to reading an income statement, even seasoned professionals can make mistakes. Let's explore some common pitfalls and how to avoid them.

Overlooking the Big Picture

One of the biggest mistakes people make is focusing too much on a single number. For example, you might see a company's revenue skyrocket and think, "Wow, they're doing great!" But hold on a second! What if their expenses grew even faster? That's why it's crucial to look at the whole statement.

Imagine you're running a lemonade stand. You sold $100 worth of lemonade (yay!), but spent $120 on lemons and sugar (oops!). Even though your sales were high, you actually lost money. This is why we need to consider both income and expenses.

Ignoring Non-Cash Items

Another tricky area is non-cash items. These are things that affect the income statement but don't involve actual money changing hands. For example, depreciation is a cost that spreads the price of a big purchase over time.

Let's say your lemonade stand bought a fancy juicer for $1000. Instead of showing it as one big expense, you might spread it out over five years. Each year, you'd show a $200 depreciation cost on your income statement. This helps match the cost with the benefit you get from using the juicer over time.

Red Flags and Warning Signs

Now, let's talk about some warning signs that might pop up on an income statement.

Unexplained Changes in Profit Margins

If a company's profit margin suddenly changes without a good reason, it's time to dig deeper. For instance, if the cost of goods sold stays the same but the gross profit drops, something fishy might be going on.

Remember Enron? This energy company looked super successful on paper, but it was hiding massive debts and inflating profits. Their income statements showed incredible growth year after year, which should have raised eyebrows. When the truth came out, the company collapsed, shocking the business world.

Inconsistent Revenue Recognition

Another red flag is when a company's revenue seems out of sync with its business model. For example, if a subscription-based service suddenly reports a huge spike in one-time sales, it might be trying to make its numbers look better than they really are.

By keeping an eye out for these pitfalls and red flags, you'll be better equipped to understand what an income statement is really telling you about a company's financial health.

Comparative Analysis: Benchmarking Performance

When it comes to understanding how well your business is doing, comparing income statements is like having a superpower. It's not just about looking at one piece of paper and calling it a day. No way! We need to put on our detective hats and do some serious sleuthing.

Why Comparing Income Statements Matters

Imagine you're running a lemonade stand. You want to know if you're making more money this summer than last summer, right? That's exactly why we compare income statements across different time periods. It helps us see if our business is growing or if we need to make some changes.

But wait, there's more! We also want to know how we're doing compared to other lemonade stands in the neighborhood. That's where comparing with competitors comes in handy. It's like a friendly competition to see who's selling the most lemonade!

How to Compare Income Statements Like a Pro

Line Up Your Statements: First, grab your income statements from different time periods or from your competitors. Put them side by side like you're lining up for a race.

Look at the Big Numbers: Start with the total revenue. Is it going up or down? This tells you if you're selling more or less lemonade over time.

Check Out the Costs: Now, look at your expenses. Are you spending more on lemons and sugar? This helps you understand if your costs are under control.

Calculate Percentages: Don't just look at the numbers, turn them into percentages. If your lemonade sales went up by 10% but your costs went up by 20%, that's important to know!

Spot the Trends: Look for patterns. Are your sales always better in July? Do you spend more on ice in August? Understanding these trends can help you plan better.

Compare with Competitors: If you have info on other lemonade stands, see how your numbers stack up. Maybe they're selling more lemonade, but you're making more profit per cup!

Ask Why: For any big differences you see, ask yourself why. Did you raise your prices? Did a new lemonade stand open nearby? Understanding the reasons behind the numbers is super important.

By following these steps, you'll become a pro at comparing income statements. It's like having X-ray vision for your business! Remember, the goal is to use this information to make your lemonade stand (or any business) even better. So put on those detective glasses and start comparing!

Advanced Techniques for Income Statement Analysis

When you're ready to dive deeper into understanding a company's financial health, it's time to explore some advanced techniques for analyzing income statements. Let's look at two powerful methods that can give you a clearer picture of how a business is performing.

Ratio Analysis: Crunching the Numbers

Ratio analysis is like using a magnifying glass on the income statement. It helps you spot important relationships between different numbers. Here are a few key ratios to consider:

Gross Profit Margin: This shows how much money is left after paying for the costs of goods sold. A higher margin usually means the company is doing well.

Operating Profit Margin: This tells you how much profit a company makes from its core business operations.

Net Profit Margin: This is the percentage of revenue that turns into profit after all expenses are paid.

By comparing these ratios over time or with other companies in the same industry, you can get a better sense of how well a business is managing its money.

Trend Analysis: Spotting Patterns

Trend analysis is like being a detective, looking for clues about a company's financial story over time. Here's how it works:

Gather income statements from several years.

Look at how key items like revenue, expenses, and profit change from year to year.

Ask yourself: Are sales growing steadily? Are expenses increasing faster than revenue?

This method can help you predict future performance and spot potential problems before they become big issues.

Leveraging Technology for Easier Analysis

Gone are the days of crunching numbers with just a calculator and pencil. Now, there are cool tools that make analyzing income statements much easier:

Spreadsheet Software: Programs like Excel or Google Sheets can help you organize data and create charts to visualize trends.

Financial Analysis Apps: These can automatically calculate ratios and create reports, saving you tons of time.

Data Visualization Tools: Turn boring numbers into exciting charts and graphs that tell a clear story about a company's performance.

With these advanced techniques and modern tools, you'll be able to unlock deeper insights from income statements and make smarter financial decisions. Remember, practice makes perfect, so don't be afraid to dive in and start analyzing!

The Role of Income Statements in Decision-Making

Income statements are like report cards for businesses. They show how much money a company made and spent over a certain time. Different people use these statements to make important choices. Let's explore how!

How Stakeholders Use Income Statements

Investors love income statements. They look at the profit to see if a company is doing well. For example, if a company's profit goes up every year, investors might decide to buy more of its stock.

Managers use income statements to make big decisions. Imagine a toy company sees that its expenses for making toys are too high. The manager might decide to find cheaper ways to make toys or raise prices to cover the costs.

Banks also look at income statements when a business asks for a loan. If the statement shows the company is making good money, the bank might say yes to the loan.

Real-Life Example: Apple's Big Decision

In 2016, Apple looked at its income statement and saw that iPhone sales were slowing down. This led to a big decision. They started focusing more on services like Apple Music and the App Store. This smart move helped Apple keep making money even when fewer people were buying new phones.

Connecting Income Statements with Other Financial Reports

Income statements don't work alone. They team up with other reports like balance sheets and cash flow statements. Together, these reports give a full picture of a company's health.

Think of it like a doctor checking your heart, lungs, and blood pressure to see how healthy you are. In the same way, looking at all these reports together helps business people make better choices.

For instance, a company might show good profits on its income statement. But if the cash flow statement shows it's having trouble collecting money from customers, that's a red flag. This complete view helps avoid making decisions based on just one part of the financial story.

By understanding how to read income statements and use them with other financial reports, anyone can make smarter choices about business and money. It's like having a superpower in the world of finance!

From Analysis to Action: Applying Income Statement Insights

Once you understand how to read an income statement, it's time to put that knowledge to work. Let's explore how you can use income statement analysis to boost your business performance and learn from successful companies.

Practical Tips for Driving Business Improvements

Track your profit margins: Keep a close eye on your gross profit margin and operating profit margin. If these numbers are shrinking, it's time to look for ways to cut costs or increase prices.

Analyze expense trends: Look at how your expenses change over time. Are certain costs growing faster than your revenue? This might be a red flag that needs attention.

Compare with industry benchmarks: See how your numbers stack up against similar companies. This can help you spot areas where you're falling behind or excelling.

Use ratios for deeper insights: Calculate ratios like the profit margin or operating expense ratio to get a clearer picture of your financial health.

Real-World Success Stories

Starbucks' Cost-Cutting Strategy: In 2008, Starbucks noticed their expenses were growing faster than revenue. By analyzing their income statement, they identified areas to cut costs, like closing underperforming stores and reducing supply chain expenses. This helped them save $580 million in just one year!

Amazon's Long-Term Vision: Amazon's income statements often showed losses in its early years. But by focusing on revenue growth and market share rather than short-term profits, they built a business that now dominates e-commerce.

Apple's Product Mix Optimization: By closely monitoring the profit margins of different product lines on their income statement, Apple has been able to focus on high-margin items like the iPhone and services, boosting overall profitability.

Remember, your income statement is more than just numbers on a page. It's a powerful tool that can guide your business decisions and strategy. By regularly analyzing your income statement and acting on those insights, you can drive real improvements in your business performance. Don't be afraid to dig into the details – that's where the most valuable insights often hide!

Driving Financial Success: Your Next Steps

As we've journeyed through the world of income statements, it's clear that mastering this financial tool is crucial for business growth. Whether you're steering a trucking company or managing a small enterprise, understanding your income statement empowers informed decision-making. But why stop here? At Path 2 Profit Bookkeeping, we're passionate about turning financial insights into actionable strategies. Ready to take your financial understanding to the next level? Let's chat about how we can help you navigate your business's financial landscape. Book a free consultation call today, and let's pave your path to profit together!

CONNECT WITH US

COPYRIGHT © 2026 BOTTCHER GROUP OF COMPANIES

8661 201st Street, 2nd Floor, Langley, BC, V2Y 0G9, Canada